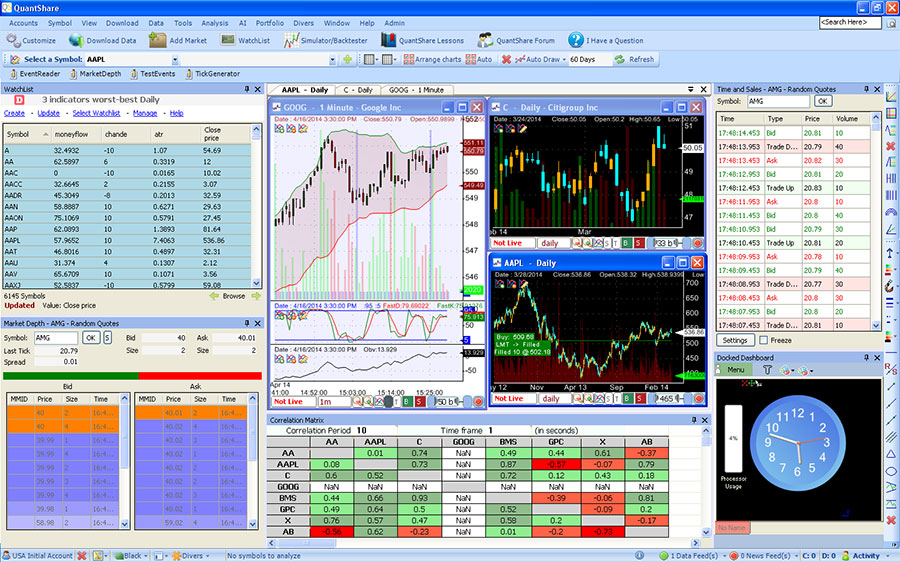

Arun the Stock Guru Stock tips,Trading Tips,Bse Nse,Share market live,Sensex,Indian Stock market. The company was suggested to the premium members few weeks ago. It has moved a good 3. Still looks a company with multibagger potential. People interested for our coming Mumbai workshop as well premium small cap services pls fill the below form. For assistance do whatsappcontact Ujjal at 9. AGM Updates Improvement in operational efficiency by reduction of manpower and raw material cost thereby improving ebidta margin. Being 7. 0 yr old co., the cos main strength is offering diverse product range designing and customising products according to the clients requirements. Supplying products services to almost all the Fortune 5. Improving topline and market share in Railways Defence segment, incurring R D expenses to develop and introduce new technology driven products and thereby improve application of product line in steel, sugar, textile, cement, energy etc. Trying to get back in defence business where we were 1. Looking forward for better results in Q3 and Q4 due to good order inflow for Mysore plant for oil fill transformers and growth seen in the abovementioned sectors. Getting orders revenue is not a problem for the co, main aim is to reduce the working capital debt and interest burden cost improve distributor network. Certain defence orders are in L1 stagelowest bidder in tenders. Expect huge market for renewable energy in India. Forex forum India Introduction. The international foreign exchange market provides opportunities for deriving highyield and highrisk profit from currency rate. Cos top mgt executives have been touring and meeting power station companies. The co will bid for a Water Grid project Irrigation scheme provide drinking water from various rivers near AP to all its various cities and expecting to get an order worth 5. Cr in Telengana state for supplying 1. Pump Set of 1. 2 Lac each. Execution will come in Q3 Q4. Recently, the co has got solar project order worth 6. Cr. It is the biggest opportunity for revenue growth. Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more. Vogaz Technical Analysis Software India MCX Software Charting Software MCX Commodity Software shares Software NCDEX Commodity live charts Commodity Trading Software. We are authorised Distributor direct vendor of real time data of Multi Commodity Exchange of India MCX and National Stock Exchange of India NSE for Currency. Was really interested in checking out which trading software has been favored by most of the traders in the world and the below metric shows which trading software is. Restructuring undertaken with banks in 2. The co has been gradually reducing the Deposits of 2. Cr and ICD of 2. Cr. Make company debt free over a period of time by disposing non core real estate assets of the co. Automated Stock Trading Software In India' title='Automated Stock Trading Software In India' />Hubli of 1. Cr, which will fetch them 1. Mysore 5 sites worth approx 5. Automated Stock Trading Software In India' title='Automated Stock Trading Software In India' /> Cr, Regional Office spaces in Delhi, Hyd, Pune, Bglr etc. Reducing debt with corporation bank. Total real estate non core assets of the company is more than 1. Cr. My view Recent step taken by the mgt regarding sale of treasury stock worth 1. Cr and QIP issue of 3. Cr was one of the brave and bold step. It has brought positivity and optimism among all the employees of the company and they will work really hard to bring it back to the top. Initial issue of working capital is solved and they have started concentrating on the business. Scuttlebutt from the biggest distributor who is with the company for last 2. If you order LVM motors today u will get it tomorrow. So there is no problem of dispatch in standard motors but if you demand for specialized one then depending upon size, features delivery time gets from 1 month to 6 months. In India, Foreign Exchange or Forex trading Overseas Trading is not allowed. If someone is found trading Forex on the stock market by the Reserve Bank of Indias. Solutions. Versatile and scalable software platforms and services allowing institutions to manage information, reduce risk and improve operational efficiency. Latest news hot off the presses from CNBC. A blog about Indian stock markets offering best stock tips and investment ideas. Recent speech from Chairman was fantastic. Expecting very good profit in next 2 years Crompton and abb are also aggressive. This company has huge land bank in banglore and hubli. Ravi series is doing good because of terminal arrangement on top side both available. Earlier only side terminal arrangement was available but now both. In terms of sales network, the company is like maruti lupin. They have purchased new land 5 to 6 years back. It is Trying to increase market share. Settlers Of Catan Gallery Edition Expansion Tanks here. It is trying to hire big guys from market. New MD had come recently and is cleaning all dust from the company. He removed all wrong people, all inventory were cleaned. Also fired people who were thinking company like government organization. New MD is silent and aggressive. I have personally felt that he is working very hard. In my 1. 5 to 2. 0 years of experience at the company I can definitely say that things are improving sharply and next 2 to 3 years will be fantastic. I am very optimistic. Trying for new supplier with new people. New MD is pure finance guy and cleaning all inventory. I have personally seen all plants of it and felt that, recently accountability responsibility has improved for each and every person. Getting quarries from lost customer which is big achievement as of now. In terms of brand, Crompton, this company, abb is preferred Order. Summary What happens when a family managed company with good products and a great brand recall changes its PSU approach to be a well managed private one Thats precisely the story of this company. They have given two professional rockstars a free hand to run the show. VB,who was the CFO of the company got promoted to be the MD around 2. AH,the star salesman with wealth of experience in the industry took the charge of being the sales head. They are churning inside out to transform the company and take it to the coveted league. The problem of the company started with the acquisition of LDW in 2. German company known for its technology. The recession followed which made the matter worse for the company. Inspite of every possible support from the Indian parent the German subsidiary couldnt turnaround. Few quarters back it finally gave up and booked the losses. They have imbibed the German technology and with the sector it caters to looking up,better days finally prevails for the company. The company posses rich non core assets to the tune of over 1. They are in active dialogue to dispose of the same worth 4. Over the course of next 2 3 years,Company would be a lean entity with no more interest cost obligations. Would be prudent to note that the present interest cost of the company would be near 4. The end users of its products aka the sugar,power,steel and cement industries have started seeing times changing for good. If your output user marks a rich turnaround,the vendor too will turnaround rightOften common sense is very uncommon,notably in case of retailers in terms of selecting listed entities. Our channel checks from its dealers network across the country vindicates the point on the demand front. Customers are having a waiting period of 2 3 weeks for its Ac Dc motors. Dealers also suggests about the renewed focus from the companys end. It has a near monopoly status in Oil Filled Transformers where its seeing huge demand. Last year they did around 1. This year they already have orders worth 9. EBITDA margins. The company always had orders but owing to working capital crunch they couldnt execute most of it. The condition went so precarious that it had to resort to selling its treasury shares in and around December 2. It garnered 2. 0crs and finally scripted a turnaround after a very long time. They did a QIP of 3. Whats a blessing in a disguise How about accumulated losses of hundreds of crores in its book which means no tax obligation till it surpasses the accumulated losses within the tax window of 7 years. Management did clarify about no MAT either. Conclusion After exactly 8 quarters or in the December 2. Last 2 quarters been profitable too for the company. It targets a 3. 0 growth where its sales are expected to surpass 7. Estimated EBITDA of 9 gives us a PAT figure of around 1. Company quotes at 2. Fy. 17 1. 8 will see it clocking 8. EBITDA expected of around 1. The Best Technical Analysis Trading Software. There are those who say a day trader is only as good as his charting software. While thats debatable, its certainly true that a key part of a traders job like a radiologists involves interpreting data on a screen in fact, day trading as we know it today wouldnt exist without market software and electronic trading platforms. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Most brokerages offer trading software, armed with a variety of trade, research, stock screening and analysis functions, to individual clients when they open a brokerage account. In fact, the bundled software applications which also boast bells and whistles like in built technical indicators, fundamental analysis numbers, integrated applications for trade automations, news, and alert features often act as part of the firms sales pitch in getting you to sign up. Much of the software is complimentary some of it may cost extra, as part of a premium package a lot of it, invariably, claims that it contains the best stock charts or the best free trading platform. Fact There is no single best stock chart, or best stock screener software. There are too many markets, trading strategies and personal preferences for that. But we can examine some of the most widely used trading software out there and compare their features. Whether their utility justifies their price points is your call. Meta. Stock One of the most popular stock trading software applications, Meta. Stock offers more than 3. Fibonacci retracement to complement technical indicators, integrated news, fundamental data with screening and filtering criteria, and global markets coverage across multiple assets equities, derivatives, forex, futures and commodities. Both its Meta. Stock Daily Charts Subscription and its Meta. Stock Real Time packages especially geared for day traders include its highly praised stock charts software. Worden TC2. 00. 0 If you are interested exclusively in U. S and Canadian stocks and funds, then TC2. Features include stock charts, watch lists, alerts, instant messaging, news, scanning, and sorting. TC2. 00. 0 offers fundamental data coverage, more than 7. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. Signal Another popular stock trading system offering research capabilities, e. Signal trading tool has different features depending upon the package. It has global coverage across multiple asset classes including stocks, funds, bonds, derivatives, and forex. Signal scores high on trade management interface with news and fundamental figures coverage, and its stock charts software allows for a lot of customization. Available technical indicators appear to be limited in number and come with backtesting and alert features. Ninja. Trader An integrated trading and charting software system, providing end to end solution from order entry to execution with customized development options and third party library integration compatible for 3. Ninja. Trader is one of the commonly used research and trading platforms. Its especially geared to futures and forex traders. While not a free trading platform, costs can be as low as. Apart from the usual technical indicators 1. Wave. 59 PRO2 Offering advanced level products for experienced traders, Wave. PRO2 offers high end functionality, including hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann based tools, training mode, and neural networks, to quote the website. Equity. Feed Workstation One prominently highlighted feature of the Equity. Feed Workstation is a stock hunting tool called Filter. Builder built upon huge number of filtering criteria that enables traders to scan and select stocks per their desired parameter advocates claim its some of the best stock screening software around. Level 2 market data is also available, and coverage includes OTC and Pink. Sheet markets. However, it offers limited technical indicators and no backtesting or automated trading. Its product specific search tools like ETFView, Sector. View, etc. rank among the best stock screening software. And it even offers free trading platforms during the two week trial period, that is. Profit. Source Targeted at active, short term traders with precise entry and exit strategies, Profit. Source claims to have an edge with complex technical indicators, especially Elliot Wave analysis and backtesting functionality with more than 4. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Vector. Vest With trading platforms and analytics software that cover different geographic regions for the U. S., UK, Australia, Canada, Singapore, Europe, Hong Kong, India, and South Africa, Vector. Vest is the one for the intercontinental crowd. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. Vector. Vest also offers strong backtesting capabilities, customization, real time filtering, watch lists, and charting tools. INO Market. Club For users specifically looking for charting software, INOs Market. Club offers technical indicators, trend lines, quantitative analysis tools, and filtering functionality integrated with a charting and trading system not just stocks, but futures, forex, ETFs and precious metals. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. You can often test drive for nothing Many market software companies offer no cost trial periods, sometimes for as long as five weeks. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost perhaps a monthly subscription instead of outright purchase while experienced traders can explore individual products selectively to meet their more specific criteria.

Cr, Regional Office spaces in Delhi, Hyd, Pune, Bglr etc. Reducing debt with corporation bank. Total real estate non core assets of the company is more than 1. Cr. My view Recent step taken by the mgt regarding sale of treasury stock worth 1. Cr and QIP issue of 3. Cr was one of the brave and bold step. It has brought positivity and optimism among all the employees of the company and they will work really hard to bring it back to the top. Initial issue of working capital is solved and they have started concentrating on the business. Scuttlebutt from the biggest distributor who is with the company for last 2. If you order LVM motors today u will get it tomorrow. So there is no problem of dispatch in standard motors but if you demand for specialized one then depending upon size, features delivery time gets from 1 month to 6 months. In India, Foreign Exchange or Forex trading Overseas Trading is not allowed. If someone is found trading Forex on the stock market by the Reserve Bank of Indias. Solutions. Versatile and scalable software platforms and services allowing institutions to manage information, reduce risk and improve operational efficiency. Latest news hot off the presses from CNBC. A blog about Indian stock markets offering best stock tips and investment ideas. Recent speech from Chairman was fantastic. Expecting very good profit in next 2 years Crompton and abb are also aggressive. This company has huge land bank in banglore and hubli. Ravi series is doing good because of terminal arrangement on top side both available. Earlier only side terminal arrangement was available but now both. In terms of sales network, the company is like maruti lupin. They have purchased new land 5 to 6 years back. It is Trying to increase market share. Settlers Of Catan Gallery Edition Expansion Tanks here. It is trying to hire big guys from market. New MD had come recently and is cleaning all dust from the company. He removed all wrong people, all inventory were cleaned. Also fired people who were thinking company like government organization. New MD is silent and aggressive. I have personally felt that he is working very hard. In my 1. 5 to 2. 0 years of experience at the company I can definitely say that things are improving sharply and next 2 to 3 years will be fantastic. I am very optimistic. Trying for new supplier with new people. New MD is pure finance guy and cleaning all inventory. I have personally seen all plants of it and felt that, recently accountability responsibility has improved for each and every person. Getting quarries from lost customer which is big achievement as of now. In terms of brand, Crompton, this company, abb is preferred Order. Summary What happens when a family managed company with good products and a great brand recall changes its PSU approach to be a well managed private one Thats precisely the story of this company. They have given two professional rockstars a free hand to run the show. VB,who was the CFO of the company got promoted to be the MD around 2. AH,the star salesman with wealth of experience in the industry took the charge of being the sales head. They are churning inside out to transform the company and take it to the coveted league. The problem of the company started with the acquisition of LDW in 2. German company known for its technology. The recession followed which made the matter worse for the company. Inspite of every possible support from the Indian parent the German subsidiary couldnt turnaround. Few quarters back it finally gave up and booked the losses. They have imbibed the German technology and with the sector it caters to looking up,better days finally prevails for the company. The company posses rich non core assets to the tune of over 1. They are in active dialogue to dispose of the same worth 4. Over the course of next 2 3 years,Company would be a lean entity with no more interest cost obligations. Would be prudent to note that the present interest cost of the company would be near 4. The end users of its products aka the sugar,power,steel and cement industries have started seeing times changing for good. If your output user marks a rich turnaround,the vendor too will turnaround rightOften common sense is very uncommon,notably in case of retailers in terms of selecting listed entities. Our channel checks from its dealers network across the country vindicates the point on the demand front. Customers are having a waiting period of 2 3 weeks for its Ac Dc motors. Dealers also suggests about the renewed focus from the companys end. It has a near monopoly status in Oil Filled Transformers where its seeing huge demand. Last year they did around 1. This year they already have orders worth 9. EBITDA margins. The company always had orders but owing to working capital crunch they couldnt execute most of it. The condition went so precarious that it had to resort to selling its treasury shares in and around December 2. It garnered 2. 0crs and finally scripted a turnaround after a very long time. They did a QIP of 3. Whats a blessing in a disguise How about accumulated losses of hundreds of crores in its book which means no tax obligation till it surpasses the accumulated losses within the tax window of 7 years. Management did clarify about no MAT either. Conclusion After exactly 8 quarters or in the December 2. Last 2 quarters been profitable too for the company. It targets a 3. 0 growth where its sales are expected to surpass 7. Estimated EBITDA of 9 gives us a PAT figure of around 1. Company quotes at 2. Fy. 17 1. 8 will see it clocking 8. EBITDA expected of around 1. The Best Technical Analysis Trading Software. There are those who say a day trader is only as good as his charting software. While thats debatable, its certainly true that a key part of a traders job like a radiologists involves interpreting data on a screen in fact, day trading as we know it today wouldnt exist without market software and electronic trading platforms. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Most brokerages offer trading software, armed with a variety of trade, research, stock screening and analysis functions, to individual clients when they open a brokerage account. In fact, the bundled software applications which also boast bells and whistles like in built technical indicators, fundamental analysis numbers, integrated applications for trade automations, news, and alert features often act as part of the firms sales pitch in getting you to sign up. Much of the software is complimentary some of it may cost extra, as part of a premium package a lot of it, invariably, claims that it contains the best stock charts or the best free trading platform. Fact There is no single best stock chart, or best stock screener software. There are too many markets, trading strategies and personal preferences for that. But we can examine some of the most widely used trading software out there and compare their features. Whether their utility justifies their price points is your call. Meta. Stock One of the most popular stock trading software applications, Meta. Stock offers more than 3. Fibonacci retracement to complement technical indicators, integrated news, fundamental data with screening and filtering criteria, and global markets coverage across multiple assets equities, derivatives, forex, futures and commodities. Both its Meta. Stock Daily Charts Subscription and its Meta. Stock Real Time packages especially geared for day traders include its highly praised stock charts software. Worden TC2. 00. 0 If you are interested exclusively in U. S and Canadian stocks and funds, then TC2. Features include stock charts, watch lists, alerts, instant messaging, news, scanning, and sorting. TC2. 00. 0 offers fundamental data coverage, more than 7. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. Signal Another popular stock trading system offering research capabilities, e. Signal trading tool has different features depending upon the package. It has global coverage across multiple asset classes including stocks, funds, bonds, derivatives, and forex. Signal scores high on trade management interface with news and fundamental figures coverage, and its stock charts software allows for a lot of customization. Available technical indicators appear to be limited in number and come with backtesting and alert features. Ninja. Trader An integrated trading and charting software system, providing end to end solution from order entry to execution with customized development options and third party library integration compatible for 3. Ninja. Trader is one of the commonly used research and trading platforms. Its especially geared to futures and forex traders. While not a free trading platform, costs can be as low as. Apart from the usual technical indicators 1. Wave. 59 PRO2 Offering advanced level products for experienced traders, Wave. PRO2 offers high end functionality, including hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann based tools, training mode, and neural networks, to quote the website. Equity. Feed Workstation One prominently highlighted feature of the Equity. Feed Workstation is a stock hunting tool called Filter. Builder built upon huge number of filtering criteria that enables traders to scan and select stocks per their desired parameter advocates claim its some of the best stock screening software around. Level 2 market data is also available, and coverage includes OTC and Pink. Sheet markets. However, it offers limited technical indicators and no backtesting or automated trading. Its product specific search tools like ETFView, Sector. View, etc. rank among the best stock screening software. And it even offers free trading platforms during the two week trial period, that is. Profit. Source Targeted at active, short term traders with precise entry and exit strategies, Profit. Source claims to have an edge with complex technical indicators, especially Elliot Wave analysis and backtesting functionality with more than 4. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Vector. Vest With trading platforms and analytics software that cover different geographic regions for the U. S., UK, Australia, Canada, Singapore, Europe, Hong Kong, India, and South Africa, Vector. Vest is the one for the intercontinental crowd. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. Vector. Vest also offers strong backtesting capabilities, customization, real time filtering, watch lists, and charting tools. INO Market. Club For users specifically looking for charting software, INOs Market. Club offers technical indicators, trend lines, quantitative analysis tools, and filtering functionality integrated with a charting and trading system not just stocks, but futures, forex, ETFs and precious metals. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. You can often test drive for nothing Many market software companies offer no cost trial periods, sometimes for as long as five weeks. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost perhaps a monthly subscription instead of outright purchase while experienced traders can explore individual products selectively to meet their more specific criteria.